Multiple Choice

Use the table for the question(s) below.

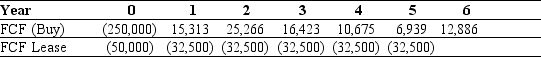

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 7% and the tax rate is 35%,what is the amount of the lease-equivalent loan for the new equipment?

A) $178,937

B) $169,070

C) $30,930

D) $21,063

E) -$14,145

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose that instead of leasing the bulldozer,the

Q13: Suppose the lease is a five-year fair

Q14: What is the difference between a fixed

Q15: Which of the following is a valid

Q16: What is the NPV of the lease

Q18: Why are loan payments typically higher than

Q19: Suppose your firm is planning on obtaining

Q20: In terms of cash flows,a non-tax lease

Q21: Canberry Energy would like to lease an

Q22: In a perfect capital market,the cost of