Multiple Choice

Use the table for the question(s) below.

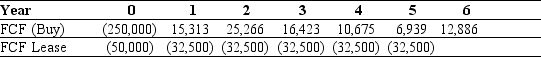

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 7% and the tax rate is 35%,what is the NPV of leasing versus borrowing?

A) $178,937

B) $169,070

C) $30,930

D) $21,063

E) -$14,145

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Kitchener Golf Course has decided to lease

Q6: What is the difference between an operating

Q7: Manitoba Medical has decided to lease a

Q8: A lease that is viewed as an

Q9: Use the table for the question(s)below.<br>Danby Construction

Q11: Suppose that the bulldozer can be leased

Q12: Suppose that instead of leasing the bulldozer,the

Q13: Suppose the lease is a five-year fair

Q14: What is the difference between a fixed

Q15: Which of the following is a valid