Multiple Choice

Use the table for the question(s) below.

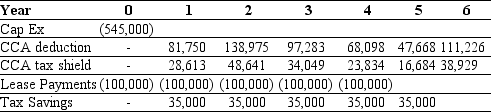

Danby Construction is considering leasing a new crane for the next 5 years.Danby has created the following table of cash flows to help with the decision:

-If Danby's borrowing cost is 7%,and its tax rate is 35%,what is the NPV of leasing versus borrowing?

A) $96,747

B) $369,671

C) $348,253

D) -$363,441

E) $75,329

Correct Answer:

Verified

Correct Answer:

Verified

Q22: In a perfect capital market,the cost of

Q23: Because finance leases increase the apparent leverage

Q24: Is St.Martin's better off leasing the CT

Q25: Should St.Martin lease the scanner or borrow

Q26: Justine decides to enter into a 6-year

Q28: For a lease in which the lessor

Q29: What is the difference between a true

Q30: Which of the following is a valid

Q31: Use the table for the question(s)below.<br> <img

Q32: Toronto Trucking has decided to lease a