Multiple Choice

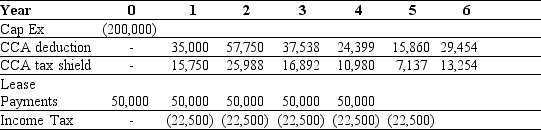

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 12% and the tax rate is 45%,what is the NPV of buying and leasing?

A) $5,422

B) $14,694

C) -$14,694

D) $15,069

E) $1,960

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Use the information for the question(s)below.<br>Suppose the

Q74: Which of the following is a valid

Q75: What is the amount of the lease-equivalent

Q76: Which of the following is a valid

Q77: Use the table for the question(s)below.<br> <img

Q78: Toronto Trucking has decided to lease a

Q80: Most leases involve a large upfront payment.

Q81: Suppose that the bulldozer can be leased

Q82: What will Luther's balance sheet look like

Q84: Why do we compare leasing to borrowing