Multiple Choice

Use the information for the question(s) below.

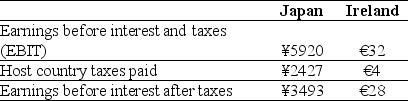

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Japanese taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Japanese operations is closest to:

A) $20.5 million

B) $29.5 million

C) $5.1 million

D) $50.0 million

E) $23.0 million

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Even though a project may generate foreign

Q72: Exchange rate risk exists if the firm's

Q97: The spot exchange rate for Indian rupees

Q98: A firm wants to hedge a potential

Q99: The amount of the taxes paid in

Q100: What is the importer-exporter dilemma?

Q102: How can deferring repatriation of earnings benefit

Q103: The amount of the taxes paid in

Q105: The spot exchange rate for the British

Q106: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt="Consider