Multiple Choice

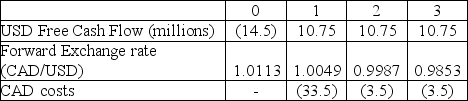

Use the table for the question(s) below.

-You own a Canadian firm that invests in a U.S.project with the cash flows shown in the table above.Given a corporate tax rate of 35% and a WACC of 6.9%,what is the NPV of the investment?

A) $16 million CAD

B) $10.5 million CAD

C) $1.1 million CAD

D) $7.5 million CAD

E) -$1.1 million CAD

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Firms that have a considerable amount of

Q53: Use the table for the question(s)below.<br> <img

Q55: The spot exchange rate for the British

Q56: If the cash flows generated by a

Q57: A Brazilian firm owes you $2,000,000,payable in

Q59: The one-year forward exchange rate for the

Q60: IBM enters into a forward contract to

Q61: At current exchange rates it takes 1.3955

Q62: The importer-exporter dilemma is caused by:<br>A)changing interest

Q63: A Canadian exporter will receive $10 million