Multiple Choice

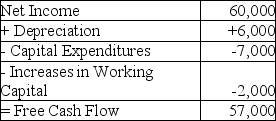

Vega Music's projected net income and free cash flows are given above in thousands of dollars.Vega expects their net income and increases in net working capital to increase by 5% per year.If Vega were able to reduce its annual increase in working capital by 10% without affecting any other part of the business adversely,what would be the effect of this reduction on Vega's value,given a cost of capital of 13%?

Vega Music's projected net income and free cash flows are given above in thousands of dollars.Vega expects their net income and increases in net working capital to increase by 5% per year.If Vega were able to reduce its annual increase in working capital by 10% without affecting any other part of the business adversely,what would be the effect of this reduction on Vega's value,given a cost of capital of 13%?

A) an increase of $500,000

B) an increase of $1,370,000

C) an increase of $2,500,000

D) an increase of $3,800,000

E) an increase of $350,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Cromwell Incorporated has

Q17: Which of the following money market investments

Q18: Jerome Industries has a cash conversion cycle

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Lionheart Inc.has the

Q20: What is the effective annual cost of

Q22: Commercial Supply Corp.bills its accounts on terms

Q23: Cooper Copper,a manufacturer of copper piping,buys copper

Q24: Franklin Industries has a current net working

Q25: Use the table for the question(s)below.<br>Luther Industries

Q26: ABX corporation had sales of $47.6 million