Multiple Choice

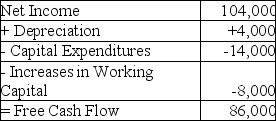

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

A) an increase of $3000

B) an increase of $8000

C) an increase of $12,000

D) an increase of $24,000

E) an increase of $258,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Macrae Products,a manufacturer of building products,buys raw

Q3: The cash conversion cycle (CCC)is defined as:<br>A)Inventory

Q4: Which of the following are the "5

Q5: ALT had $25 million in sales last

Q6: Your firm purchases goods from its supplier

Q9: Which of the following is/are direct costs

Q10: The amount of cash a firm is

Q11: Jerome Industries has inventory days of 48,accounts

Q12: SwenCorp had sales of $154 million this

Q106: Working capital alters a firm's value by