Multiple Choice

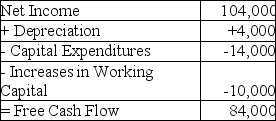

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

A) $2,000

B) $4,200

C) $5,800

D) $10,000

E) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A firm that chooses a low-risk, restrictive

Q31: What is a firm's operating cycle?

Q72: Working capital management involves the management of

Q84: Which of the following money market investments

Q88: Franklin Industries has a current net working

Q89: The amount of cash a firm needs

Q90: Jen Industries had sales of $32 million

Q93: What is meant by the term 1.5/14

Q94: Gencom International has inventory days of 12,and

Q95: Use the table for the question(s)below.<br>Luther Industries