Multiple Choice

Use the information for the question(s) below.

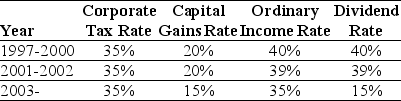

Consider the following tax rates:

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 1 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

A) $.35 million

B) $2.90 million

C) $1.75 million

D) $5.85 million

E) $3.25 million

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Why might a firm choose a spinoff

Q16: A firm has $500 million of assets

Q17: What is the sequence of the four

Q18: Why do firms still pay dividends,despite their

Q19: Repurchases and special dividends are useful for

Q21: The idea that dividend changes reflect managers'

Q22: The date on which a firm pays

Q23: An alternate way to pay investors is

Q24: Which of the following is an advantage

Q25: When a firm retains cash,it pays corporate