Multiple Choice

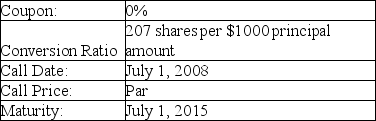

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $4.95.If the bonds are called on this date,which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $4.95.If the bonds are called on this date,which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A) Convert the bond and accept shares with a value of $10,000.

B) Convert the bond and accept shares with a value of $10,128.00.

C) Convert the bond and accept shares with a value of $10,239.13.

D) Convert the bond and accept shares with a value of $10,246.50.

E) Accept the call price and receive $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q69: A bond that makes payments in a

Q91: Which of the following is an advantage

Q92: Supreme Industries issues the following announcement to

Q93: Which of the following terms best describes

Q94: When a callable bond sells at a

Q95: Alberta Energy issues $150 million in straight

Q98: Explain the difference between notes and debentures.

Q99: A firm issues $500 million in twenty-year

Q100: What is a Canada call?

Q101: Which of the following statements is most