Multiple Choice

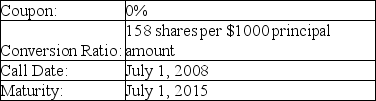

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $6.58.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $6.58.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par

B) par plus 0.6%

C) par plus 4%

D) par plus 6%

E) par plus 8%

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Private debt cannot be in the form

Q102: When would a firm choose to call

Q103: What kind of corporate debt must be

Q104: Covenants in a bond contract restrict the

Q105: Gepps Cross Industries issues debt with a

Q106: A company issues a callable (at par)ten-year,7%

Q108: Which of the following is a typical

Q109: Clearview Corporation,a company that deals mainly with

Q111: On July 1,2014,The Government of Canada issues

Q112: The purchase by a group of private