Multiple Choice

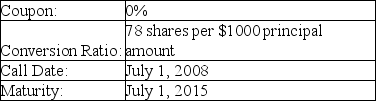

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par plus 6.66%

B) par plus 7.50%

C) par plus 8.46%

D) par plus 12.32%

E) par plus 15.00%

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Bond covenants tend to increase a bond

Q51: If a bond covenant is not met,

Q86: A firm issues $200 million in ten-year

Q87: Which of the following statements regarding a

Q88: Alberta Energy issues $85 million in straight

Q90: Smithfield Enterprises issues debt with a maturity

Q91: Which of the following is an advantage

Q92: Supreme Industries issues the following announcement to

Q93: Which of the following terms best describes

Q94: When a callable bond sells at a