Multiple Choice

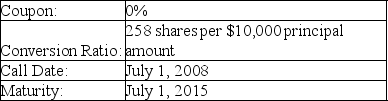

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $36.00.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $36.00.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par

B) par plus 2.6%

C) par plus 3.0%

D) par plus 3.4%

E) par plus 4.1%

Correct Answer:

Verified

Correct Answer:

Verified

Q23: What is the difference between secured and

Q24: A company issues a callable (at par)five-year,7%

Q25: BC Brewery issues $120 million in straight

Q26: A bond issue that does NOT trade

Q27: What kind of corporate debt has a

Q29: A company issues a callable (at par)five-year,7%

Q30: A company issues a callable (at par)ten-year,6%

Q31: Athelstone Realty issues debt with a maturity

Q32: What is a call provision?<br>A)the periodic repurchasing

Q33: In terms of public offerings of bonds,what