Multiple Choice

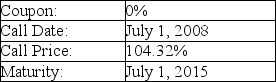

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $28.20.What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $28.20.What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A) 32 shares per $1000 principal amount

B) 35 shares per $1000 principal amount

C) 37 shares per $1000 principal amount

D) 41 shares per $1000 principal amount

E) 45 shares per $1000 principal amount

Correct Answer:

Verified

Correct Answer:

Verified

Q55: A bond has a face value of

Q57: A callable bond with the call price

Q58: Which of the following statements concerning the

Q59: Which of the following statements about bonds

Q61: A firm raising capital by issuing callable

Q62: Bonds issued by a foreign company in

Q63: A callable bond will typically have a(n)_

Q64: How might equity holders benefit from bond

Q65: Which of the following best describes an

Q92: What are callable bonds?