Multiple Choice

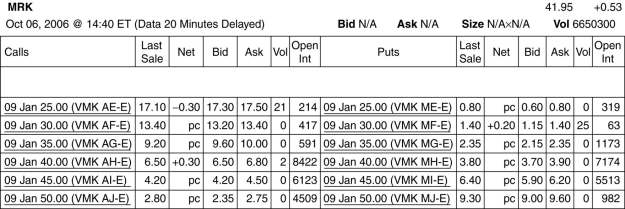

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one options contract with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

A) $680

B) $380

C) $650

D) $420

E) $450

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The _ is the total number of

Q5: Suppose a stock is currently trading for

Q6: The value of a call option _

Q7: Suppose a stock is currently trading for

Q9: When is an option at-the-money?

Q9: According to put-call parity,which of the following

Q10: The price of a European put option

Q11: In practice,option prices are not very sensitive

Q13: The payoff to the holder of a

Q49: What effect does volatility of the underlying