Multiple Choice

Use the table for the questions below

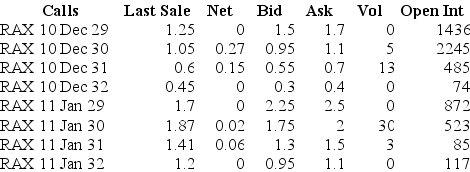

Consider the following information on options from the CBOE for Rackspace.

-Assume you want to sell 20 call option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A) $4500

B) $2600

C) $3900

D) $4000

E) $3500

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Standard stock options are traded and bought

Q37: When is an option out-the-money?

Q42: ABX corporation stock is currently trading for

Q43: The Black-Scholes formula is notable because it

Q45: You have shorted a call option on

Q46: You have shorted a call option on

Q48: An investor purchases a call option and

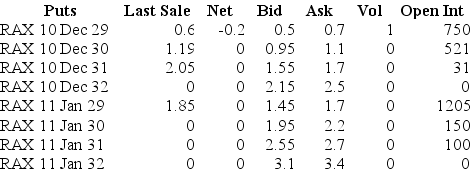

Q49: How many of the January 2009 put

Q50: Use the table for the questions below<br>Consider

Q52: _ is the relationship between the value