Multiple Choice

A company that uses the perpetual inventory system purchased 500 pallets of industrial soap for $7,000 and paid $750 for the freight-in. The company sold the whole lot to a supermarket chain for $13,000 on account. The company uses the specific-identification method of inventory costing. Which of the following entries correctly records the cost of goods sold?

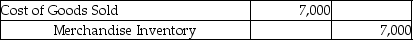

A)

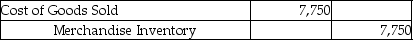

B)

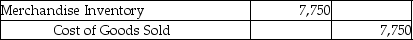

C)

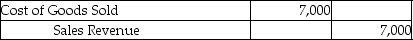

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A company uses weighted-average method of inventory

Q8: Adams Consultancy has the following account balances

Q9: Thomas Company provided the following particulars for

Q10: Given the same purchase and sales data,

Q11: The cost of goods available for sale

Q13: The total cost spent on inventory that

Q14: Clark Sales sold 450 units of product

Q15: A company purchased 100 units for $30

Q16: The disclosure principle states that a company

Q17: Williams Company had the following balances and