Multiple Choice

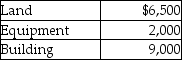

Hastings Company has purchased a group of assets for $15,000. The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

A) $1,962

B) $5,571

C) $1,714

D) $7,714

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: A lump-sum purchase or basket purchase involves

Q37: An intangible asset is an asset with

Q119: Businesses should not deplete natural resources because

Q120: If the sale price of a plant

Q122: Trimer Corp junks a truck which was

Q124: The gain or loss on the sale

Q127: Cost of an asset is $1,000,000 and

Q128: Trimer Corp sold a truck for $15,000

Q137: Exchanges of plant assets that have commercial

Q211: Land and land improvements are one and