Multiple Choice

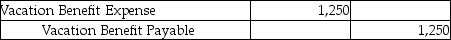

Tryst Inc. has a policy of accruing $1,500 for every employee as a vacation benefit. Sarah, an employee, took a vacation. Which of the following is the correct journal entry for the vacation benefit paid?

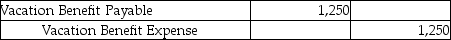

A)

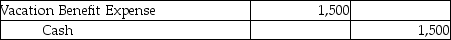

B)

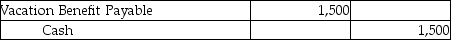

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: Sara Digital starts the year with $2,500

Q52: Sara Digital starts the year with $2,500

Q53: A high interest-coverage ratio indicates a business's

Q54: FICA tax is a tax which is

Q55: The Bergan Corp. has gross pay for

Q58: Which of the following is pay over

Q59: Art Parrish, the sole employee of Parrish

Q60: A certain contingent liability was evaluated at

Q61: On April 10, 2013, Peter Services received

Q94: Federal income taxes are _.<br>A) deducted to