Multiple Choice

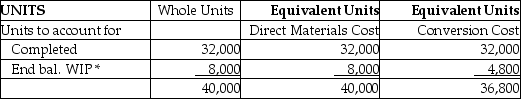

LDR Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments-Mixing, Refining, and Packaging. On January 1, 2014, the first department, Mixing, had no beginning inventory. During January, 40,000 fl. oz. of chemicals were started in production. Of these, 32,000 fl. oz. were completed and 8,000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process and conversion costs are applied evenly through the process. At the end of the month, LDR calculated equivalent units in the Mixing Department as shown below:  * % of completion for direct materials costs: 100%

* % of completion for direct materials costs: 100%

% of completion for conversion costs: 60%

During January, the Mixing Department incurred $48,000 in direct materials costs and $211,600 in conversion costs. How much was the cost per equivalent unit for materials and for conversion costs?

(Use the weighted average method and round your answer to the nearest cent)

A) $6.00 for materials, $5.29 for conversion

B) $1.20 for materials, $6.61 for conversion

C) $1.50 for materials, $6.61 for conversion

D) $1.20 for materials, $5.75 for conversion

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Under process costing,the unit cost of the

Q58: Under a process costing system,product costs are

Q99: The direct labor costs and manufacturing overhead

Q101: When indirect materials are issued to production,the

Q127: Process costing is the most appropriate costing

Q137: Cost amounts that are transferred out of

Q139: During September, the Filtering Department of Olive

Q139: The _ account is credited to adjust

Q140: The Assembling Department of Mat Liners had

Q143: Under a process costing system, inventory data