Multiple Choice

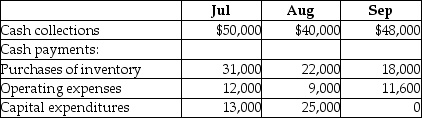

A3+ has prepared its 3rd quarter budget and provided the following data:  The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of July?

The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of July?

A) $0

B) $5,000

C) $15,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The capital expenditures budget is prepared before

Q26: Caplico Company has prepared the following sales

Q28: Freightcan Holders has provided the following extracts

Q30: Freighters Inc. has the following budgeted figures:

Q31: The final step in the process of

Q32: Fly GenX Inc. has the following budgeted

Q33: Junk Fries has budgeted sales for June

Q34: Budgeting requires managers to decide upon the

Q138: Which of the following statements is true

Q163: Budgeted financial statements are financial statements based