Multiple Choice

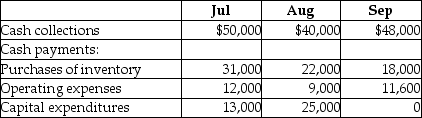

A3+ has prepared its 3rd quarter budget and provided the following data:  The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of August?

The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of August?

A) $15,000

B) $5,000

C) $10,000

D) $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The _ details how the business expects

Q89: Which of the following is an example

Q90: Dry Fruit Grocers a local grocer has

Q91: A manufacturing company's budgeted income statement includes

Q92: Unlike a manufacturing company, the cash budget

Q93: A manufacturer has budgeted sales for the

Q96: For a merchandiser, the budgeted sales equals

Q97: While preparing the budgeted income statement of

Q98: Which of the following statements is true

Q99: A3+ has prepared its 3rd quarter budget