Multiple Choice

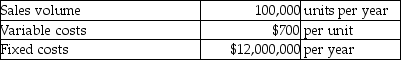

Meson Production is a price-taker. It produces large spools of electrical wire in a highly competitive market, so it practices target pricing. The current market price of the electric wire is $800 per unit. The company has $3,000,000 in assets and its shareholders expect a return of 6% on assets. The company provides the following information:  If fixed costs cannot be reduced, how much reduction in variable costs will be needed to achieve the profit target?

If fixed costs cannot be reduced, how much reduction in variable costs will be needed to achieve the profit target?

A) $180,000

B) $12,000,000

C) $2,180,000

D) $4,200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A company produces 1,000 packs of chicken

Q38: In making product mix decisions under constraining

Q39: Centric Sail Makers manufacture sails for sailboats.

Q40: Gotham Products is a price-taker and uses

Q41: Gotham Products is a price-taker and uses

Q43: Fixed costs are relevant to a special

Q44: Revenue at the market price less the

Q45: Dong Fang Company fabricates inexpensive automobiles for

Q46: DM Corporation has provided you with the

Q47: Rica Company is a price-taker and uses