Multiple Choice

John wins the lottery and has the following three payout options for after-tax prize money: 1. $150,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the first option? Round to nearest whole dollar.

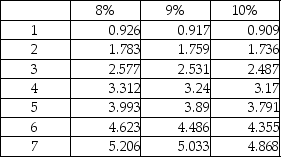

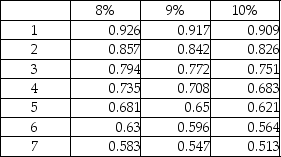

Present value of annuity of $1:  Present value of $1:

Present value of $1:

A) $750,000

B) $672,900

C) $450,000

D) $450,050

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The fact that invested cash earns income

Q90: Nylan Manufacturing is considering two alternative investment

Q91: If an investment project's IRR is higher

Q93: Compound interest assumes that all interest earned

Q94: The payback method can only be used

Q96: Under conditions of limited resources, when a

Q97: Paramount Company is considering purchasing new equipment

Q98: Which of the following best describes the

Q99: Flip Flop company is considering investing in

Q133: Which of the following best describes the