Multiple Choice

John wins the lottery and has the following three payout options for after-tax prize money: 1. $50,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $500,000 (lump sum) six years from now

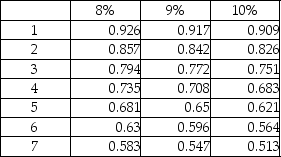

The required rate of return is 9%. What is the present value if he selects the third option? Round to nearest whole dollar.

Present value of $1:

A) $250,000

B) $230,000

C) $238,400

D) $298,000

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Clapton Corporation is considering an investment in

Q37: When calculating the net present value of

Q38: Logy Inc. is evaluating two possible investments

Q40: Caliber Company is considering the purchase of

Q43: The following details are provided by Dopler

Q44: The term net present value means the

Q45: Gamma Company is considering an investment proposal

Q46: Gamma Company is considering an investment opportunity

Q112: Compound interest means that interest is calculated

Q121: Which of the following two methods are