Multiple Choice

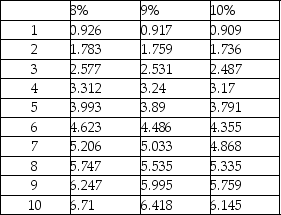

A company is considering an iron ore extraction project which requires an initial investment of $500,000 and will yield annual cash flows of $150,000 for 4 years. The company's hurdle rate is 9%. What is the NPV of the project?

A) positive $14,000

B) negative $100,000

C) positive $100,000

D) negative $14,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following details are provided by Dopler

Q3: The accounting rate of return method evaluates

Q5: Software Hub is deciding whether to purchase

Q6: Arriyana has just received an inheritance of

Q7: The following details are provided by a

Q8: A major criticism of the payback method

Q9: The payback method and the accounting rate

Q10: The accounting rate of return method focuses

Q49: Capital rationing is a process adopted when

Q73: Which capital budgeting method uses accrual accounting,rather