Multiple Choice

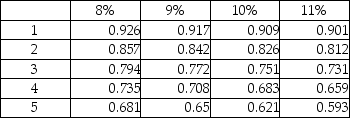

Gladeer Company is evaluating an investment that will cost $520,000 and will yield cash flows of $300,000 in the first year, $200,000 in the second year, and $100,000 in the third and final year. Use the tables below and determine the internal rate of return. Present value of $1:  The IRR of the project will be:

The IRR of the project will be:

A) between 9% and 10%.

B) less than 8%

C) less than 9%, more than 8%

D) more than 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Net cash inflows from a capital investment

Q56: Which of the following is a capital

Q57: Following details are provided by Dopler Company.

Q58: Discounted cash flow methods consider the time

Q59: James has just won the lottery after

Q60: The residual value is discounted as a

Q62: Net present value is defined as the

Q63: Which of the following is true of

Q64: The last step in the capital budgeting

Q65: The payback period and accounting rate of