Multiple Choice

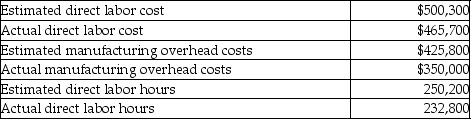

Quick Step Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Quick Step Company uses direct labor hours as the allocation base, what would the predetermined manufacturing overhead rate be?

If Quick Step Company uses direct labor hours as the allocation base, what would the predetermined manufacturing overhead rate be?

A) $1.50 per direct labor hour

B) $1.70 per direct labor hour

C) $1.40 per direct labor hour

D) $1.83 per direct labor hour

Correct Answer:

Verified

Correct Answer:

Verified

Q304: Shiloh Company uses a job costing system.

Q305: Ohio Steel uses a job costing system.

Q306: Poland's Paints allocates overhead based on machine

Q307: Morgan Company uses a job costing system.

Q308: The main driver of indirect costs for

Q310: The amount of overallocation or underallocation is

Q311: Generally accepted accounting principles (GAAP)mandate that manufacturing

Q312: Calico Corporation produced 2,000 units in Job

Q313: Under a perpetual inventory system, the journal

Q314: Which of the following would be an