Multiple Choice

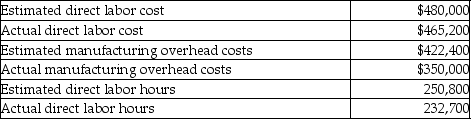

Quick Step Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Quick Step Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

If Quick Step Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

A) $350,000

B) $748,584

C) $409,376

D) $422,400

Correct Answer:

Verified

Correct Answer:

Verified

Q281: Payroll-related costs for factory employees who do

Q282: Which of the following is not a

Q283: Spruce Company uses a job costing system.

Q284: In the basic flow of inventory through

Q285: How do you calculate the predetermined manufacturing

Q287: Assigning manufacturing overhead costs and other indirect

Q288: The amount of overallocation or underallocation should

Q289: If manufacturing overhead has been overallocated during

Q290: To allocate manufacturing overhead to specific jobs,

Q291: A graphic designer spends 44 hours working