Multiple Choice

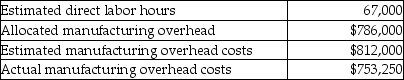

The following information was gathered for the Tutu Corporation for the most recent year. Manufacturing overhead is allocated using direct labor hours.  By how much is manufacturing overhead over or underallocated?

By how much is manufacturing overhead over or underallocated?

A) $26,000 overallocated

B) $26,000 underallocated

C) $32,750 overallocated

D) $58,750 underallocated

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Allocating manufacturing overhead costs is done<br>A)during the

Q54: Nadal Company is debating the use of

Q55: The end goal of process costing and

Q56: Which of the following entries would be

Q57: Since a service firm does not carry

Q59: Allocated manufacturing overhead is always recorded<br>A)with a

Q60: Management can use job cost information to

Q61: To record direct labor costs incurred, which

Q62: The predetermined indirect cost allocation rate is

Q63: The journal entry to issue $630 of