Multiple Choice

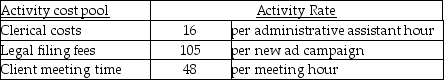

Howard, Fine, & Howard is an advertising agency. The firm uses an activity-based costing system to allocate overhead costs to its services. Information about the firm's activity cost pool rates follows:  Stooge Company was a client of Howard, Fine, & Howard. Recently, 9 administrative assistant hours, 3 new ad campaigns, and 10 meeting hours were incurred for the Stooge Company account.

Stooge Company was a client of Howard, Fine, & Howard. Recently, 9 administrative assistant hours, 3 new ad campaigns, and 10 meeting hours were incurred for the Stooge Company account.

Using the activity-based costing system, how much overhead cost would be allocated to the Stooge Company account?

A) $939

B) $459

C) $169

D) $3718

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Back Porch Company manufactures lawn chairs using

Q25: Refined costing systems can be used to

Q26: OP Technologies Manufacturing manufactures small parts and

Q27: The cost of fixing defective units found

Q28: Costs incurred to avoid providing poor quality

Q30: A lean company typically strives to lengthen

Q31: Which of the following cost of quality

Q32: As compared to traditional volume-based costing using

Q33: The cost of inspection at various stages

Q34: Beartowne Enterprises uses an activity-based costing system