Multiple Choice

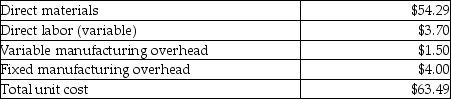

Faux Trees Company produces artificial Christmas trees. A local shopping mall recently made a special order offer; the shopping mall would like to purchase 240 extra-large white trees. Faux Trees Company is currently producing and selling 20,000 trees; the company has the excess capacity to handle this special order. The shopping mall has offered to pay $140 for each tree. An accountant at Faux Trees Company provides an estimate of the unit product cost as follows:  This special order would require an investment of $9000 for the molds required for the extra-large trees. These molds would have no other purpose and would have no salvage value. The special order trees would also have an additional variable cost of $5.59 per unit associated with having a white tree. This special order would not have any effect on the company's other sales. If the special order is accepted, the company's operating income would increase (decrease) by

This special order would require an investment of $9000 for the molds required for the extra-large trees. These molds would have no other purpose and would have no salvage value. The special order trees would also have an additional variable cost of $5.59 per unit associated with having a white tree. This special order would not have any effect on the company's other sales. If the special order is accepted, the company's operating income would increase (decrease) by

A) $13,800.00 decrease.

B) $17,980.80 decrease.

C) $8980.80 increase.

D) $17,980.80 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Each month, Burrel Incorporated produces 500 units

Q92: A "relevant cost" is best described by

Q93: Heinz Manufacturing produces Item Q with variable

Q94: Mountaintop golf course is planning for the

Q95: Blue Technologies manufactures and sells DVD players.

Q97: Lie Around Furniture manufactures two products: Futons

Q98: Westfall Watches has two product lines: Luxury

Q99: Philadelphia Swim Club is planning for the

Q100: Blue Ridge Bicycles uses a standard part

Q101: Part P40 is a part used in