Multiple Choice

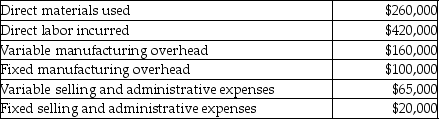

Tunnel Incorporated provided the following information regarding its single product:  The regular selling price for the product is $80. The annual quantity of units produced and sold is 40,000 units (the costs above relate to the 40,000 units production level) . The company has excess capacity and regular sales will not be affected by this special order. There was no beginning inventory.

The regular selling price for the product is $80. The annual quantity of units produced and sold is 40,000 units (the costs above relate to the 40,000 units production level) . The company has excess capacity and regular sales will not be affected by this special order. There was no beginning inventory.

What would be the effect on operating income of accepting a special order for 2500 units at a sale price of $54 per product assuming additional fixed manufacturing overhead costs of $15,000 are incurred? (Round any intermediary calculations to the nearest cent.)

A) Decrease by $78,425

B) Decrease by $63,425

C) Increase by $63,425

D) Increase by $78,425

Correct Answer:

Verified

Correct Answer:

Verified

Q83: Costs that differ between alternatives are irrelevant.

Q84: Boots Plus has two product lines: Hiking

Q85: Boots Plus has two product lines: Hiking

Q86: A price-setter company emphasizes a cost-plus approach

Q87: The following information relates to current production

Q89: Tunnel Incorporated provided the following information regarding

Q90: Served Inc. manufactures two products, salad plates

Q91: Each month, Burrel Incorporated produces 500 units

Q92: A "relevant cost" is best described by

Q93: Heinz Manufacturing produces Item Q with variable