Multiple Choice

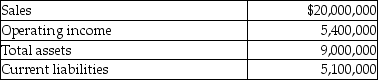

Ocelot Corporation had the following results last year (in thousands) . Management's target rate of return is 30% and the weighted average cost of capital is 5%. Its effective tax rate is 40%.  What is the division's Return on Investment (ROI) ?

What is the division's Return on Investment (ROI) ?

A) 166.67%

B) 27.00%

C) 60.00%

D) 105.88%

Correct Answer:

Verified

Correct Answer:

Verified

Q116: Golden Corporation has operating income of $315,000,

Q117: The Top Hat Division of Blandon's Fine

Q118: Potential duplication of costs is a disadvantage

Q119: A favorable variance causes operating income to

Q120: A flexible budget is a budget prepared

Q122: Management by exception is used to determine

Q123: Flexible budgets are budgets that summarize cost

Q124: New product development time may be an

Q125: The manager of the accounting department that

Q126: The Pasta Division of Whole Grain Corporation