Essay

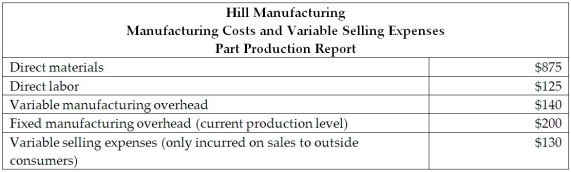

Hill Manufacturing is a large manufacturer that produces a part that inserts into diesel engines. The company has several large divisions and the managerial accountant reported the part is currently produced in the assembly department. The managerial accountant reported that the variable selling expenses and manufacturing costs related to the production of this part include the following:

Another department at Hill Manufacturing is set up to produce the diesel part and could produce the part internally rather than purchase the part from an outside supplier. The managerial accountant reported that the other department has excess capacity and could produce the part in that department. There is a significant amount of competition in the marketplace and the current price to produce the part at the other internal department and a competitor is $1,500.

Another department at Hill Manufacturing is set up to produce the diesel part and could produce the part internally rather than purchase the part from an outside supplier. The managerial accountant reported that the other department has excess capacity and could produce the part in that department. There is a significant amount of competition in the marketplace and the current price to produce the part at the other internal department and a competitor is $1,500.

What is the highest transfer price that the managerial accountant should pay to purchase the part from a competitor? Calculate the lowest acceptable transfer price if the part was produced by the internal operations at the other department at Hill Manufacturing.

Correct Answer:

Verified

The highest transfer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q211: With regard to flexible budgets, which of

Q212: List and describe reasons why a company

Q213: The Box Manufacturing Division of the Allied

Q214: Using _ may cause a manager to

Q215: Summer Nights sells bottles of bug spray

Q217: The _ perspective of the balanced scorecard

Q218: The production line at Morningstar Farms may

Q219: The volume variance is the difference between

Q220: Discuss potential problems and disadvantages to an

Q221: The performance reports of cost centers only