Multiple Choice

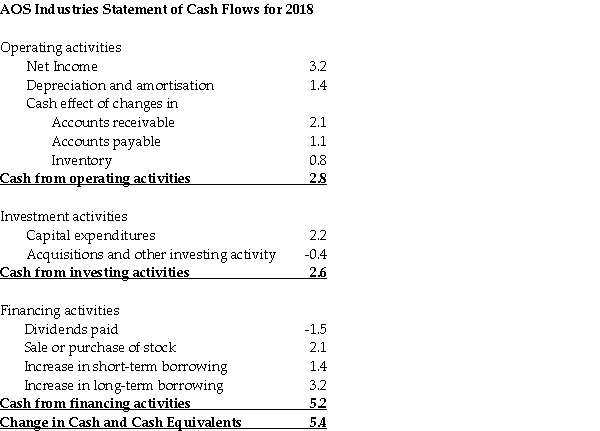

Use the table for the question(s) below.

-Consider the above statement of cash flows. In 2018, AOS Industries had contemplated buying a new warehouse for $2 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of 2018?

A) It would have $150 000 less cash at the end of 2018.

B) It would have $2 000 000 less cash at the end of 2018.

C) It would have $1 950 000 less cash at the end of 2018.

D) It would have an additional $50 000 in cash at the end of 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use the table for the question(s)below. <img

Q10: Luther Corporation Consolidated Balance Sheet 30 June

Q11: Which ratio would you use to measure

Q13: A 30-year mortgage loan is a<br>A)Long-term Liability.<br>B)Current

Q15: Convex Industries has inventories of $150 million,

Q16: Which of the following is likely to

Q17: Use the table for the question(s)below. <img

Q18: Use the table for the question(s)below. <img

Q19: How does a firm select the dates

Q19: Use the table for the question(s)below.<br>Luther Corporation