Multiple Choice

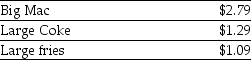

Use the table for the question(s) below.

Consider the following prices from a McDonald's Restaurant:

-A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.79. Does an arbitrage opportunity exists and, if so, how would you exploit it and how much would you make on one value meal?

A) No, no arbitrage opportunity exists.

B) Yes, buy a value meal and then sell the Big Mac, Coke and fries to make arbitrage profit of $0.38.

C) Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $1.09.

D) Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $0.68.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: What is one of the prerequisite conditions

Q19: You own 1 050 shares of Ausback

Q20: An investment will pay you $150 in

Q22: A company that manufactures copper piping is

Q24: Any arbitrage opportunity will exploit any mispricing

Q25: If the risk-free rate of interest (r<sub>f</sub>)is

Q26: The timeline shown below best describes the

Q27: Whenever a good trades in a competitive

Q28: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3082/.jpg" alt="Consider

Q74: A dollar today and a dollar in