Multiple Choice

Use the information for the question(s) below.

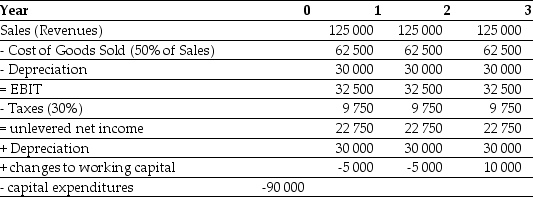

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-Luther Industries has outstanding tax loss carryforwards of $70 million from losses over the past four years. If Luther earns $15 million per year in pre-tax income from now on, in how many years will Luther first pay taxes?

A) 4 years

B) 7 years

C) 5 years

D) 2 years

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Which of the following formulas will correctly

Q64: Which of the following best defines 'incremental

Q65: A capital budget lists the projects and

Q66: Use the information for the question(s)below.<br>The Sisyphean

Q67: Vernon-Nelson Chemicals is planning to release a

Q68: The fact that a new product typically

Q70: Which of the following is usually NOT

Q73: Why does the option to abandon a

Q73: An oil company is buying a semi-submersible

Q74: A manufacturer of peripheral devices for PCs