Multiple Choice

Use the information for the question(s) below.

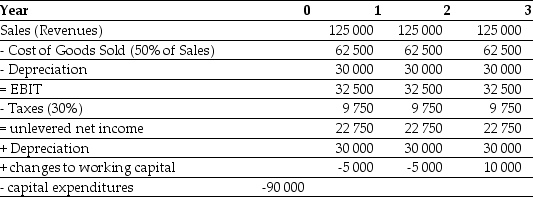

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-A firm is considering changing their credit terms. It is estimated that this change would result in sales increasing by $1 000 000. This in turn would cause inventory to increase by $150 000, accounts receivable to increase by $100 000, and accounts payable to increase by $75 000. What is the firm's expected change in net working capital?

A) $325 000

B) $175 000

C) $250 000

D) $1 175 000

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Use the figure for the question(s) below.

Q34: How do we handle interest expense when

Q49: Which of the following formulas will correctly

Q73: An oil company is buying a semi-submersible

Q74: A manufacturer of peripheral devices for PCs

Q75: Capital budgeting decisions use the Net Present

Q76: Use the table for the question(s)below. <img

Q79: Use the information for the question(s)below.<br>The Sisyphean

Q80: A brewer is launching a new product-brewed

Q82: A company planning to market a new