Multiple Choice

Use the information for the question(s) below.

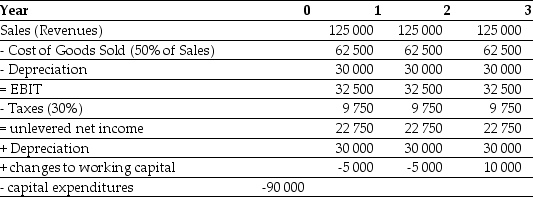

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-A firm is considering investing in a new machine that will cost $600 000 and will be depreciated using the straight-line method over five years. If the firm's marginal tax rate is 30%, what is the annual depreciation tax shield of purchasing the machine?

A) $36 000

B) $120 000

C) $234 000

D) $107 692

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Use the table for the question(s)below. <img

Q56: Use the table for the question(s)below. <img

Q57: A stationery company plans to launch a

Q58: Use the information for the question(s)below.<br>Epiphany Industries

Q59: An announcement by the government that they

Q62: Use the information for the question(s)below.<br>Temporary Housing

Q63: Use the information for the question(s)below.<br>The Sisyphean

Q64: Which of the following best defines 'incremental

Q65: When evaluating the effectiveness of an improved

Q65: A capital budget lists the projects and