Multiple Choice

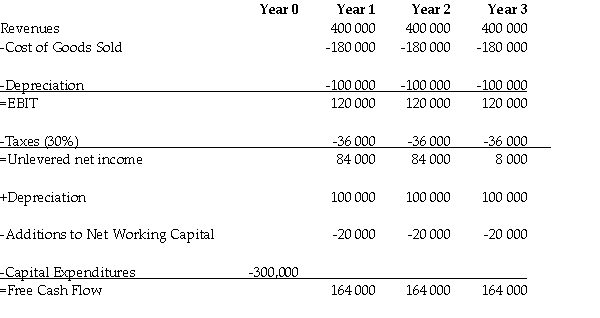

Use the table for the question(s) below.

-Which of the following statements is FALSE?

A) When evaluating a capital budgeting project, financial managers should make the decision that maximises net present value (NPV) .

B) Sensitivity analysis reveals which aspects of the project are most critical when we are actually managing the project.

C) The break-even level of an input is the level for which the investment has an internal rate of return (IRR) of zero.

D) The most difficult part of capital budgeting is deciding how to estimate the cash flows and the cost of capital.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Firms should use the most accelerated depreciation

Q17: What is the major difference between scenario

Q35: What are the most difficult parts of

Q43: A small manufacturer that makes clothes pegs

Q45: Only include as 'incremental expenses' in your

Q46: Use the information for the question(s)below.<br>The Sisyphean

Q47: A consumer good company is developing a

Q51: What is 'break-even analysis'?

Q53: An analysis that breaks the net present

Q93: The cash flow effect from a change