Multiple Choice

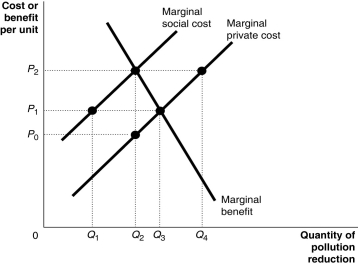

-Refer to Figure 15-9. Let's suppose the government imposes a tax of $50 per ton of toilet paper to bring about the efficient level of production. What happens to the market price of toilet paper?

A) It rises by $50.

B) It rises by more than $50.

C) It rises by less than $50.

D) It remains the same because the tax is imposed on producers who create the externality.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: When products that create positive externalities are

Q32: Figure 15.6 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 15.6

Q46: Haiti was once a heavily forested country.

Q167: Figure 15.8 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 15.8

Q179: Which of the following could be evidence

Q181: An external benefit is created when you

Q183: The Coase theorem states that<br>A)government intervention is

Q228: Economists working at federal government agencies have

Q242: If you burn your trash in the

Q265: A public good is<br>A) a good that