Multiple Choice

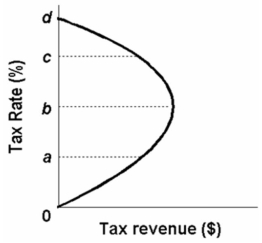

-Refer to the above diagram.If tax rates are between b and d,then supply-side economists are of the opinion that a(n) :

A) increase in tax revenues will increase tax rates.

B) decrease in tax rates will increase tax revenues.

C) increase in tax rates will increase tax revenues.

D) decrease in tax revenues will decrease tax rates.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -The above diagram

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q15: The initial aggregate demand curve is AD<sub>1</sub>

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q34: If there is sufficient time for wage

Q45: The Phillips Curve suggests that, if government

Q59: Supply-side economists criticize non supply-side economists for:<br>A)not

Q92: Assuming prices and wages are flexible, a

Q116: The Laffer Curve suggests that lower tax