Multiple Choice

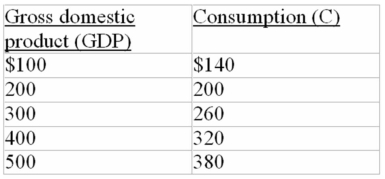

-Refer to the above data.A 10 percent proportional tax on income would:

A) affect neither the size of the multiplier nor the stability of the economy.

B) increase the size of the multiplier and make the economy more stable.

C) increase the size of the multiplier and make the economy less stable.

D) reduce the size of the multiplier and make the economy more stable.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The impact of an expansionary fiscal policy

Q25: The most likely way the public debt

Q82: A contractionary fiscal policy is shown as

Q126: A contractionary fiscal policy shifts the aggregate

Q198: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q202: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q208: What percentage of the public debt is

Q213: You are given the following information about

Q220: In an economy, the government wants to

Q227: In a certain year the aggregate demand