Multiple Choice

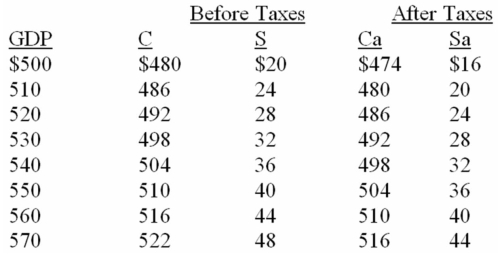

-The tax in the above economy is a:

A) 10 percent proportional tax.

B) lump-sum tax of $20.

C) lump-sum tax of $10.

D) progressive tax.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q39: Exports have the same macroeconomic effect on

Q84: The effect of imposing a lump-sum tax

Q93: Imports have the same macroeconomic effect on

Q125: If at some level of GDP the

Q152: Refer to the below diagram,which aggregate expenditure

Q155: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q157: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -In equilibrium in

Q160: The table shows the consumption schedule for

Q161: A lump-sum tax causes the after-tax consumption

Q223: At equilibrium real GDP in a private