Essay

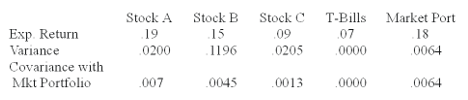

Given the following information on 3 stocks:

Using the CAPM, calculate the expected return for Stock's A, B, and C. Which stocks would you recommend purchasing?

Correct Answer:

Verified

Indifferent on A a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Indifferent on A a...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q4: The dominant portfolio with the lowest possible

Q21: The CML is the pricing relationship between:<br>A)

Q23: The elements along the diagonal of the

Q29: For a highly diversified equally weighted portfolio,

Q35: If the correlation between two stocks is

Q37: The separation principle states that an investor

Q50: Given the range of betas on actual

Q55: You have plotted the data for two

Q57: When a security is added to a

Q126: The diagram below represents an opportunity set