Multiple Choice

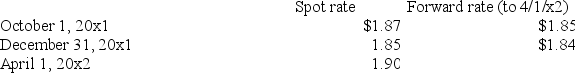

Amazing Corporation, a U.S. enterprise, sold product to a customer in Wales on October 1, 20x1 for £100,000 with payment required on April 1, 20x2. Relevant exchange rates are:  The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

What term is used to describe the circumstances under which Amazing Corporation is entering the forward contract?

A) Hedge of an unrecognized foreign currency firm commitment

B) Hedge of a recognized foreign-currency-denominated asset

C) Hedge of a forecast foreign-currency-denominated transaction

D) Hedge of net investment in foreign operations

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under U.S. GAAP, where are changes in

Q2: On December 1, 2001 Pimlico made sales

Q3: On December 1, 2001 Pimlico made sales

Q4: Which of the following statements is true

Q6: King's Bank, a British company, purchases market

Q7: What information is needed to determine the

Q8: The number of Japanese yen (¥) required

Q9: What is the intrinsic value of a

Q10: On 1 January, 2015, Hikers Inc., a

Q11: What is the requirement for reporting derivatives