Multiple Choice

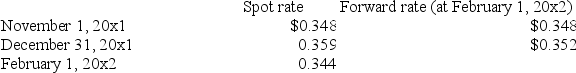

On November 1, 2001 Zamfir Company, a U.S. corporation, purchased minerals from a Russian company for 2,000,000 rubles, payable in 3 months. The relevant exchange rates between the U.S. and Russian currencies are given:  The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

Assume that on November 1, 2001 Zamfir Company enters a forward contract to buy 2,000,000 rubles on February 1, 2002. What is the fair value of the forward contract on December 31, 2001?

A) $8,000

B) $7,800

C) $22,000

D) $8,200

Correct Answer:

Verified

Correct Answer:

Verified

Q32: On December 1, 2001 Pimlico made sales

Q33: What is "hedge accounting?"<br>A) Any record keeping

Q34: What is a foreign currency transaction?<br>A) It

Q35: Amazing Corporation, a U.S. enterprise, sold product

Q36: Under International Accounting Standards Board rules, what

Q38: In hedge accounting, which of the following

Q39: How should discounts or premiums on forward

Q40: How is the fair value of a

Q41: A bank exchanging foreign currency makes its

Q42: Under U.S. GAAP, foreign exchange losses should