Multiple Choice

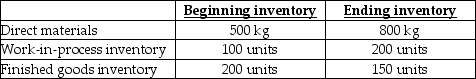

Use the information below to answer the following question(s) .Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00, direct manufacturing labour is $6.00, and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour, and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2019:

-On the 2019 budgeted income statement, what amount will be reported for cost of goods sold?

A) $132,975

B) $135,675

C) $134,325

D) $135,000

E) $155,000

Correct Answer:

Verified

Correct Answer:

Verified

Q123: Use the information below to answer the

Q124: Lubriderm Corporation has the following budgeted sales

Q125: A production budget expressed in units is

Q126: Mannock Company budgeted $400,000 for employee training,

Q127: Use the information below to answer the

Q129: A controllable cost is a cost that

Q130: Direct material purchases equal<br>A)usage plus production needs.<br>B)production

Q131: Answer the following question(s)using the information below.Furniture

Q132: The budget constraint describes only financial limitations

Q133: Use the information below to answer the